A report by the Congressional Budget Office (CBO) finds that proposed changes to the tax code could reduce charitable contributions. However, the CBO does not expect religious organizations to be affected because religious donors are less sensitive to the tax benefits of contributions. Instead, it is the charities favored by the rich—the arts, education, and healthcare—that are more likely to see lowered donations.

Congress is currently considering possible changes to the current tax code, which allows individuals to deduct their charitable contributions from their taxable income. President Obama has proposed a reduction in how much contributions would those making more than $250,000 a year. Rather than receiving a tax savings of 33 or 35 percent (the tax rate for the higher-income brackets), these income earners would receive a 28 percent tax savings.

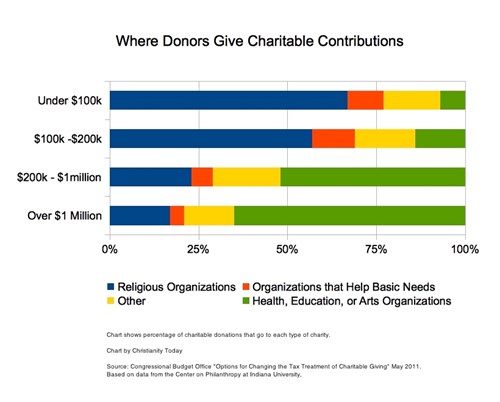

This type of reduction is most likely to affect donations to large institutions such as colleges, hospitals, and foundations, not churches and smaller religious charities. Using data from the Center on Philanthropy at Indiana University, the CBO reports that those with the highest income give the least percentage of their donations to religious organizations.

Those making more than $200,000 a year give a quarter of their donations to religious groups; those making more than $1 million give one-sixth of their contributions to churches. Most of the donations from the rich go to large institutions.

This pattern stands in stark contrast to those with incomes less than $100,000. These individuals give two-thirds of their donations go to religious groups. These individuals also give a greater percentage of their income to organizations that help the poor with their basic needs (10-12 percent) than do those with high income (4-6 percent).

"In its main analysis, CBO assumed that all charitable contributions are sensitive to changes in the after-tax price of giving," the report says. "However, taxpayers' regular donations to churches and other religious organizations may be less price-responsive than other contributions."

The CBO examines a mix of changes to the tax code. These changes included

– allowing all tax-payers to deduct contributions even if they don't itemize their tax deductions.

– placing a single rate for tax deductions much like Obama has proposed. Two possible levels are 15 percent and 28 percent.

The CBO concludes that, in general, allowing all taxpayers to deduct contributions without itemizing all their tax deductions would increase contributions to charities. This would hold even if the tax reduction rate was set at 25 percent. However, if the deduction for donations was set at 15 percent (the rate for the lowest tax bracket), donations to charities would drop by four to five percent.

Support Our Work

Subscribe to CT for less than $4.25/month