More than half of new church plants (58%) are financially self-sufficient by their fourth year, a LifeWay Research study shows.

Almost a quarter (23%) are financially independent in their first year.

LifeWay tracked the financial steps of 843 church plants in 17 denominations that started in 2008 or later and are still operating today.

On average, financial self-sufficiency developed steadily over time. In the beginning, most churches received contributions from their attendees but relied primarily on donations from outside sources. LifeWay tracked the sources of initial funding:

- 89% offerings from church attendees

- 72% an affiliated denomination

- 56% a personal financial support network created by the church’s lead pastor or staff

- 52% one or more sponsoring churches

- 52% church’s pastor or staff

- 26% single individual or non-profit foundation

Within a few years, the bulk of the church’s income, on average, shifted from outside to inside sources.

While a quarter of church plants (24%) indicated that the “work has faced a financial crisis,” there were also strong signs of health. The majority of church plants have a “proactive stewardship development plan” that aims to help the church achieve self-sufficiency (60%). Most are also able to financially contribute to other church plants (58%).

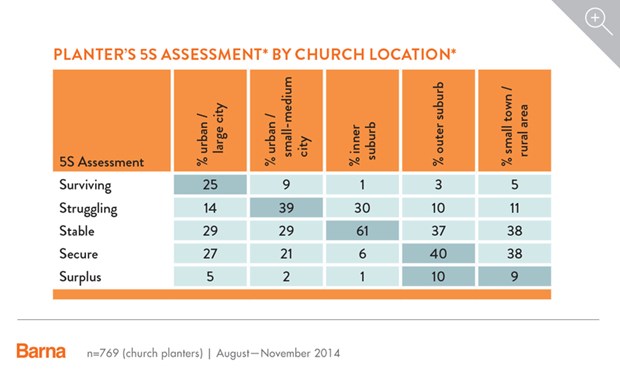

Those who struggle are more likely to be in urban areas, according to a Barna survey:

Urban centers and their surrounding communities are often diverse, but may be segregated by race, education level, economics, age, and cultural differences. Thus, urban planters are more likely to have diverse congregations with varying levels of income and needs, as well as higher operational and facility expenses, than their suburban or rural counterparts. Plus, residents of urban centers, no matter their level of income, live in environments with a higher cost of living. This puts extra strain on a church planter’s personal finances.

A quarter of church planters (25%) in the urban areas of large cities told Barna they were “surviving” on their household income; in other words, they “require financial assistance to get by.” Fewer planters in smaller cities (9%), inner suburbs (1%), outer suburbs (3%), and rural areas (5%) reported that they were “surviving.”

The farther away from large cities the planters were, the less likely they were to report personally struggling to keep up with day-to-day expenses, and the more likely they were to report that they were making ends meet or had more than they needed.

(CT previously compared the money problems of church planters and other pastors.)

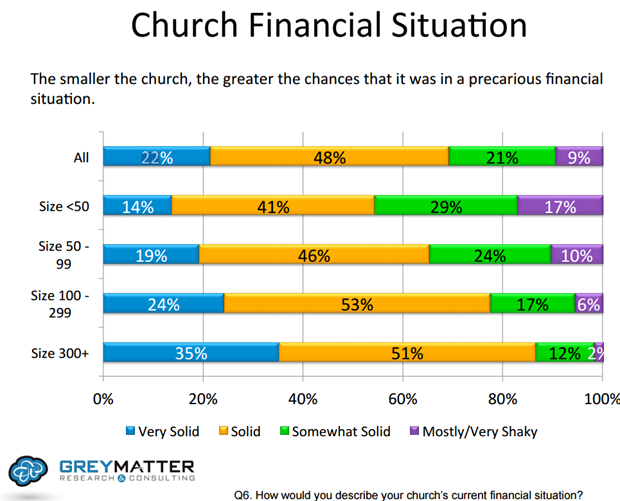

Overall, 1 out of 10 churches is on “shaky financial ground” (9%), a National Associations of Evangelicals (NAE) study reported recently. One out of five (22%) reports being “very solid.”

Those shaky churches are more likely to be small, like church plants. Churches with fewer than 50 attendees are the only group more likely to be on shaky (17%) than very solid (14%) financial ground.

On the other end of the spectrum, churches with more than 300 congregants are far more likely to be very financially solid (35%) than very shaky (2%).

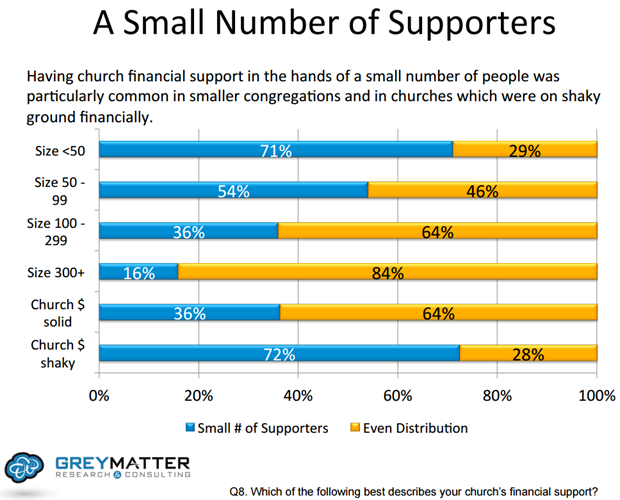

The insecurity of a church’s financial situation correlates with the number of people who are keeping it afloat, the NAE reported. Nearly three-quarters of churches (72%) that derive most of their income from a small number of donors report being financially insecure.

Another correlation: Churches that have fewer than 50 members were more likely to receive the bulk of their income from a few people.

Perhaps not surprisingly, pastors at those small churches were less likely (41%) to use positive words (respectful, transparent, generous, organized, constructive, professional, unifying) to describe the financial culture at their church than those with 50 to 99 members (47%), 100 to 299 members (53%), or more than 300 members (63%).

And pastors at churches with solid finances were more likely (55%) than those who were on shaky ground (32%) to use positive words to describe their church’s financial culture.

However, pastors overall were far more likely (92%) to use a positive term than they were (36%) to use a negative one (delegated, uncomfortable, disorganized, miserly, lacking transparency, adversarial, divisive, disrespectful) when describing their church’s culture when it came to discussing church finances.

Support Our Work

Subscribe to CT for less than $4.25/month