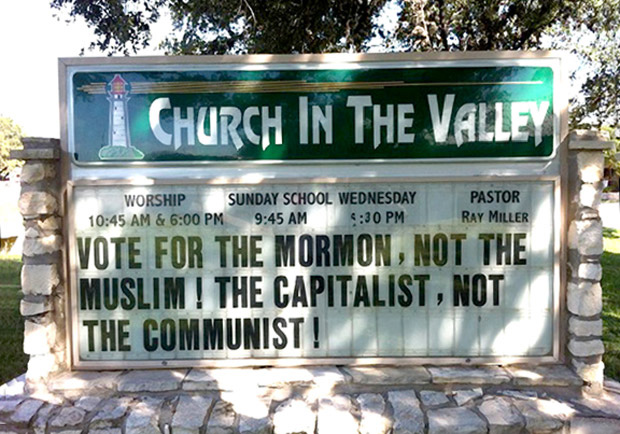

"Vote for the Mormon, not the Muslim! The Capitalist, not the Communist!" read the sign outside Church of the Valley in Leakey, Texas. Beyond its inaccuracies, it was a clear violation of federal tax code, which prohibits nonprofits from doing anything that might support a candidate running for office.

But a revocation of the church's tax-exempt status isn't likely to come soon—if ever.

The Internal Revenue Service (IRS) has officially halted tax audits of churches until it can adopt rules that clarify which high-level employee has the authority to initiate them.

"We are holding any potential church audits in abeyance," Russell Renwicks of the IRS's Tax-Exempt and Government Entities division told BNA.com this week.

While this is the first public announcement of the moratorium, the IRS hasn't been auditing churches since 2009, said Erik Stanley, senior legal counsel with the Alliance Defending Freedom (formerly the Alliance Defense Fund).

That's when a federal court found that the IRS wasn't following its own regulations.

An IRS official at the level of regional commissioner or above is required to approve any church audits before they are initiated, according to a law passed in 1984. But in 1996, Congress reorganized the IRS from geographical regions to national practice groups—a move that eliminated the office of regional commissioner.

"The IRS designated an official within [its] exempt organizations section to be the one to approve the church audits," Stanley said.

But that position did not rank high enough to be adequate, the court decided after a Minnesota church challenged the legitimacy of their audit in 2009.

"The IRS shut down all church audits at the time," Stanley said. The agency proposed new regulations in 2009, but never got past the review process, he said.

"After that, it has taken absolutely no action on finalizing the regulations," he said. "They've just been sitting out there."

No one seems to know why the IRS hasn't changed its regulations to allow another position to approve the audits, or why IRS commissioner Douglas Shulman hasn't been approving church audits in the interim. Shulman will step down November 9, the end of his five-year term.

"They could finalize those regulations whenever they wanted to," Stanley said.

Rob Boston, senior policy analyst for Americans United for the Separation of Church and State, also doesn't know why the finalization has taken so long.

"All we get are drops of information here and there, which sometimes seem to point in different directions," he said.

The hotly contested presidential election this year has seen plenty of churches violate the rules, Boston said.

"This is absolutely the worst time for the IRS to be taking a step back," he said. "The agency needs to resolve this matter and move forward with enforcement. If they fail to do that, we're only going to see more flagrant violations of the law."

But most pastors don't need the IRS to stop them from offering voting advice from the pulpit. According to a recent LifeWay Research poll, almost 90 percent of Protestant pastors believe they should keep endorsements out of the pulpit—up from about 85 percent who felt that way last year.

On the other hand, most pastors—79 percent, according to a 2011 LifeWay survey—believe the government should not "regulate sermons by revoking a church's tax exemption if its pastor approves of or criticizes candidates based on the church's moral beliefs or theology."

Sally Wagenmaker, an attorney who works with nonprofits, said she urges her clients to exercise caution when using the "vote" word.

"However, the more the government has been appropriating areas of morality, the closer we get to this intersection of churches not able to speak upon acute [moral] issues in a political campaign," she said. "There has never been a better time to challenge constitutionality. [And] this is probably the worst time [for the IRS] to push on enforcing this prohibition."