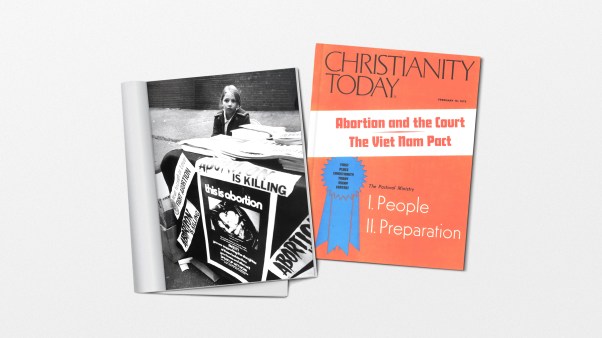

The U.S. Supreme Court ruled unanimously that states may impose taxes on the sale of Bibles and religious materials. In an opinion written by Justice Sandra Day O’Connor, the Court said a sales tax “threatens no excessive entanglement between church and state.”

“The sales and use tax is not a tax on the right to disseminate religious information, ideas, or beliefs per se; rather, it is a tax on the privilege of making retail sales of tangible personal property,” O’Connor wrote.

The decision came in a case brought by evangelist Jimmy Swaggart, who was protesting $180,000 in sales taxes levied by California on books and tapes sold during and after crusades held in the state. Swaggart had argued that the taxes threatened his religious liberty. “The evangelist’s activity is not a commercial enterprise activity designed to make a profit,” his attorneys said.

The decision did not address whether the Court would consider the exchange of religious material in return for a donation as a taxable sale.

A broad coalition of religious groups, including the Evangelical Council for Financial Accountability, Prison Fellowship, and the National Council of Churches, had supported Swaggart in the case, citing fears about the implications for evangelistic ministry and religious fund raising. “Our concern is that it would have a chilling effect on the religious activity of the evangelist who travels from state to state and sells materials as part of his ministry,” said Michael Woodruff, acting executive director of the Christian Legal Society.

Also disturbing, Woodruff said, is the potential for more aggressive tax action in the future. “We don’t see the fences carefully erected here to restrain government from imposing general taxation schemes on churches,” he said.

Oliver Thomas, general counsel for the Baptist Joint Committee, told CHRISTIANITY TODAY he believes the impact of the decision will be limited. “This is not a tax on religion; it is a tax on commercial activity,” in which few local churches engage, he said. However, he was quick to add that he never likes to see “any kind of administrative burden imposed on the church.” Thomas said the Court left open the possibility that there could be “a tax so burdensome that it choked off religious free speech.”