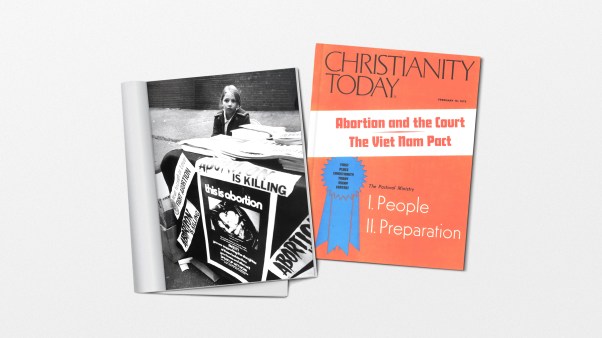

Some groups, especially those that regularly comment on political and social issues, are concerned that the proposed regulations would limit free speech. Others, such as the Evangelical Council for Financial Accountability (ECFA), share the IRS’s goals, believing it is necessary to begin setting guidelines for online ministry and fundraising.

The major concern of some advocacy organizations is that they will not be allowed to link to political sites, or even sites with a small percentage of political content on the Internet. Other proposals would require nonprofits to take greater responsibility for message-board postings and chat-room conversations.

Republican House Majority Leader Dick Armey condemned the IRS review, saying that “turning the tax man into a Net cop would have a chilling effect on free speech on the Internet.”

Wendy Wright, director of communications for Concerned Women for America, agrees. She worries that the IRS proposals would limit the amount of political coverage her organization supplies to Christians.

“We should all agree that we want Americans to have access to the maximum amount of information and political commentary,” Wright told Christianity Today.

The IRS review was open to comment from nonprofits through February 13, 2001, after which, the IRS said, it would reassess its proposals. Even if the IRS eventually decides to enforce the guidelines, adopting them would very likely be “a very slow process” according to Paul Nelson of the ECFA.

“We’re in a for quite a shakeout period,” Nelson CT. “The technology, the number of players, and the size of investments on the Internet changes radically every six months.”

Nelson believes that while this rapid turnover complicates ethical issues, it also creates a unique opportunity for Christians to serve as the voice for ethical standards that benefit all Web users.

The ECFA has held seven Internet symposiums for its member organizations in the past six months. It plans to offer at least five more meetings this year to spur Christian ministries to develop acceptable protocols for issues like Internet fundraising and distinguishing between hyperlinks to other nonprofits and those to political or business sites.

“We don’t think that having a hyperlink is really the problem, but visitors should be able to tell when they leave a nonprofit site,” Nelson said. “There are plenty of ways that organizations can make it clear.”

If the IRS turns the proposal into policy, some nonprofits hope that John Ashcroft, President Bush’s nominee for attorney general, will lend some leadership to the debate.

Ashcroft’s record as an advocate for privacy and encryption on the Internet have earned him respect from many Internet libertarians, while his support of federal funding for faith-based programs has earned him respect from Christian organizations. The ECFA, for example, worked with Ashcroft’s office when he was researching faith-based initiatives.

“The ECFA doesn’t make political statements,” Nelson told CT, “but my personal opinion is that John Ashcroft’s principles as a Christian will help him to take a balanced stance on many difficult issues.”

Copyright © 2001 Christianity Today. Click for reprint information.

Related Elsewhere

The Evangelical Council for Financial Accountability has all its members pledge to uphold seven standards of responsible stewardship, and it urges organizations with Web sites to set up even stricter standards than are currently required by law.Other stories about the IRS’s Internet proposals for tax exempt organizations include:

IRS Internet review worries tax-exempt groups—The Associated Press (Dec. 27, 2000)

New IRS Rules Could Hinder Work of Christian Groups—Chritianity.com (Nov. 12, 2000)