Three defendants with connections to the Open Bible Standard Churches were found guilty in late August in federal court for conspiracy to commit fraud and money laundering in a $7 million investment scheme.

Their scheme, called World Fidelity Bank (WFB), sold fraudulent certificates of deposit to and through churches, church members, and other persons for more than two years, assistant U.S. attorney Pat Crank said during the trial.

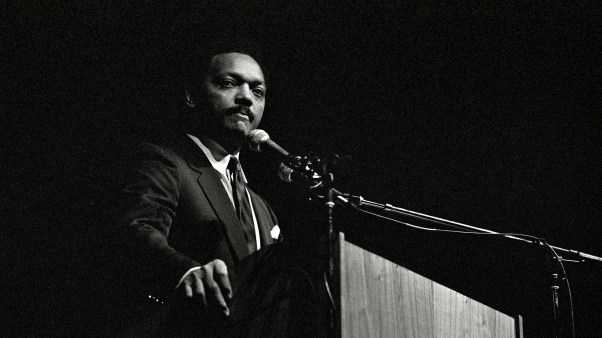

The bank existed only on paper. “World Fidelity Bank was a figment of many people’s imaginations,” Crank said. “Investors believed their money was being invested by a financial genius, a retired preacher from South Dakota,” Crank said of E. LaVay McKinley. But ex-Open Bible minister McKinley and defendants George Jim Conway and Steve Emery took investors’ money and, for the most part, gave investors worthless paper, he said. “The truth is, investors’ hard-earned money was just blown” on speculative investments and personal expenses.

Defense attorneys for Emery and Conway unsuccessfully argued that McKinley misled their own clients. McKinley’s attorney claimed his client believed the bank was legitimate and that he had no intention of defrauding anyone.

The jury found Emery and Conway guilty of one count each of conspiracy to commit mail fraud, wire fraud, and money laundering. McKinley, the prime organizer of World Fidelity Bank, was found guilty of eight counts of conspiracy to commit mail fraud, wire fraud, and money laundering.

Conway and Emery face a maximum penalty of five years in prison and a $250,000 fine. McKinley faces up to 20 years and a $500,000 fine. Attorneys have made no decision whether to appeal.

The indictment handed down last December stated that the defendants “made virtually no real investments with money obtained from certificates of deposit holders” (CT, Feb. 8, 1993, p. 56). Defendants wired money between bank accounts around the world “to deceive investors by concealing that no ‘bank’ actually existed and that WFB had no income-producing investments.”

Witnesses in the trial said that by October 1992 the defendants had run out of money and were deported as undesirable aliens from the Bahamas. Meanwhile, they were meeting with an undercover FBI agent who billed himself as an accountant for an illicit drug cartel, which could lend them drug profits to pay off their creditors.

Much of World Fidelity Bank’s initial success came from McKinley’s connections through the Des Moines-based Open Bible Standard Churches. The denomination’s early investments of $45,000 from 1988–91 “made incredible money,” Crank said. “Open Bible Standard was very pleased with its investment, and word was passed from pastor to pastor.” The denomination itself later invested $213,000, or 9 percent of its administrative assets. Denomination president Ray Smith declined to discuss the verdicts with CHRISTIANITY TODAY or to disclose the net loss sustained by the denomination.

By Tom Morton in Cheyenne, Wyoming.