Many Christians associate the term “stewardship” with giving, but it actually includes all aspects of managing the wealth that God puts into our hands—and that includes making wise investments. In today’s go-go climate of speculation, where daytraders and dot-com millionaires are often in the limelight, it’s easy for people to equate prudent investing (for retirement or a child’s college education) with Las Vegas–style gambling.

There’s one huge difference, however, between a biblical perspective on investing and our current cultural infatuation with millionaire-mania, and that’s the issue of ownership. Many of today’s most daring investors take wild risks for one goal—to become rich. Christians, on the other hand, are already rich, but not in material assets—those belong to God.

The bedrock of a biblical understanding of wealth is that it all belongs to God, but he entrusts us to manage it during our lifetime. Our task is to decide how to divide the pie. How much do we give away to help meet the needs of others and expand God’s kingdom? How much do we consume on our own needs? And how much do we set aside for future needs?

We’re basically trustees, and a trustee normally does not take high risks with the owner’s wealth. When you entrust assets to a financial manager, you expect rational plans for putting that money to work, not unreasonable risks in hopes of a quick payoff.

The desire to get rich quickly drowns out the biblical voice that counsels us to set aside from our current abundance against a future need. Proverbs 6:6–8 extols the humble ant, which despite its insectival intelligence has the wit to put aside resources to meet the needs of an uncertain future. It’s reasonable to assume that—after we’ve given to God’s work—if God gives us more than we currently need, then like the ant we should set aside some portion of that surplus.

It’s also sensible for us to invest that surplus and seek the best reasonable return on that investment. Yet the spectrum of financial investing runs from ultrasecure, low-interest bonds to the wild and woolly world of speculating in options and commodity futures. Most people will want to stick to the middle of that spectrum.

Jesus walked the earth long before the modern stock market, but there is no doubt that he was familiar with all the concepts involved. Consider his parable of the talents (Matthew 25:14–28). The master in the story followed basic investment principles that still make sense. For example, he diversified. He did not put all his assets in the hands of a single individual. What’s more, over time he eliminated ineffective investment options and switched to those that worked.

Matthew recorded Jesus’ parable of the talents primarily to illustrate that the leaders of Israel would be held accountable to God for their stewardship of the nation. The “wicked, lazy” steward had not even invested his assets with the first-century equivalent of an insured, low-interest savings account. The drastic punishment he received implied that, in the realm of stewardship, doing nothing is as bad as thievery or reckless waste. Yet the master in the parable applauded the other two stewards for their faithfulness.

The principles we can draw from this parable remain applicable in the modern world of the NASDAQ and index funds. God has given us assets for which we will ultimately face an accounting. We should invest those assets wisely, yet the owner of those assets remains God, not us.

Money invested in various chunks spread out along the middle of the spectrum of risk will likely grow over time. But increased wealth brings with it the temptation to assume ownership of those assets. Jesus often cautioned people about the dangers of trusting in riches (Matthew 6:24). We are all too prone to trust God with our finances when young and poor but then to begin to trust in wealth should God multiply our funds.

We must remember that God remains the owner, and he may one day tell us it is time for those investments to be put to work in his kingdom. The temptation to think of God’s assets as “ours” is one that increases with investment success, and we need to periodically remind ourselves of this fact.

From time to time, I’m convinced, God uses financial setbacks to jog our memory about who really owns it all. When there’s a major free-fall in the market, or some particular investment heads south, or there’s some other significant assault on the assets God put into our hands—that’s the time to repeat aloud a few times: “It all belongs to God.”

J. Raymond Albrektson is associate professor of New Testament at the International School of Theology, Rancho Cucamonga, California, and the author of Living Large: How to Live Well—Even on a Little.

Related Elsewhere

Dr. J. Raymond Albrektson is an associate professor at the International School of Theology.

Albrektson also teaches short courses (typically Old Testament Survey, New Testament Survey, Church History Survey, Introduction to Inductive Bible Study) around the world, most recently in the former countries of the USSR.

Click here for listings of articles Albrektson has published.

His book, Living Large: How to Live Well—Even on a Little, is available from Worthy books.

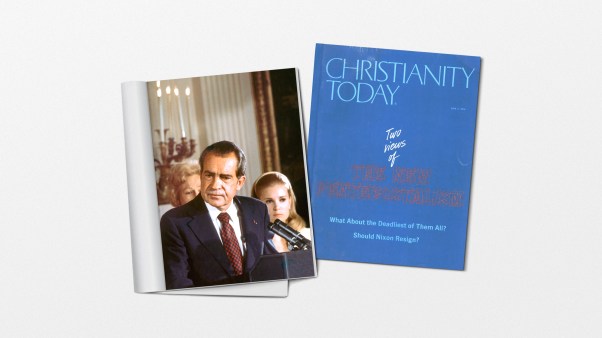

Previous Christianity Today stories about investment and finances include:

We’re in the Money! | How did evangelicals get so wealthy, and what has it done to us? (June 9, 2000)

The Culture of the Market: A Christian Vision | A Coptic bishop explains biblical economics to a Muslim newspaper. (Dec. 6, 1999)

Keeping Up with the Amish | We evangelicals have made a too-easy peace with the inroads of consumer culture. (Oct. 4, 1999)

Pious Profits? | ‘Socially responsible’ investing grows popular. (Sept. 6, 1999)

Copyright © 2000 Christianity Today. Click for reprint information.