I walked into the car dealer, wrote a check for nearly $14,000, and drove off the lot in a brand-new minivan. After my grandfather died in 1988, I received an inheritance and spent most of it on a sa-weet suburban mom ride to replace the series of unreliable vintage vehicles I'd been driving for years.

Once the new-car smell faded, it dawned on me that I possessed the last tangible mark of my grandfather's life working as a traveling salesperson. Fast-forward to 2012, and I wonder if I can leave my own children and grandchildren enough to buy a tricycle. Nor am I certain it is a wise goal to leave them a bundle of cash and a houseful of stuff.

Is this fiscal heresy? Another example of Baby Boomer selfishness?

I'm wrestling with these questions. And the reality is that many of my age peers are heading into retirement with hummingbird-sized nest eggs. According to a recent study from the Employee Benefit Research Institute, 60 percent of workers surveyed reported retirement savings and investments of less than $25,000, excluding home values. And we all know what's happened to the value of those homes in many parts of the country. Throw in the shaky future of Social Security, and the net result may well exhaust the resources of many Boomers long before the end of their days.

As a result, the American Dream has faded from the lives of many of our children. I resonate with the very real fiscal frustration expressed by a member of the Millennial generation in a recent issue of The Atlantic:

Ultimately, members of my father's generation … are reaping more than they sowed. They graduated smack into one of the strongest economic expansions in American history. They needed less education to snag a decent-salaried job than their children do, and a college education cost them a small fraction of what it did for their children or will for their grandkids. One income was sufficient to get a family ahead economically. Marginal federal income-tax rates have fallen steadily, with rare exception, since boomers entered the labor force; government retirement benefits have proliferated. At nearly every point in their lives, these Americans chose to slough the costs of those tax cuts and spending hikes onto future generations.

Some of my generation's poor choices have come as we slavishly pursued youth, wealth, and cool, a Dollar Store version of eternal life. Other poor choices have arisen from our votes, our vices, and our grand sense of self-importance.

Christians who came of age during the Jesus Revolution may wish they could point to our generation's rich spiritual legacy, but far too many of us have seen our children exit the very churches we helped to build, attend, and staff.

What will our legacy be, Boomers? Should the Lord tarry, will our children and grandchildren inherit from us nothing more than wind?

There is no do-over for past choices. Some of my own past poor decisions have flowed from places of sin in my life. Other poor decisions occurred as a result of brokenness, both my own and in reaction to the sin of others. Still others came out of my own unconsidered assent to cultural values. I wanted a new minivan because it suited my suburban lifestyle. At the time, Dee, a friend from church, gave me a handy comparison that I used to evaluate the wisdom of my own purchase. Dee used the first meager profits from her husband's business start-up to get breast implants, then a couple of vacations in a warm climate so she could audition her new bikini body. The business failed, and her young family spent several years descending from their mountain of debt. I recognize today that I used a flawed litmus test to justify my relatively pragmatic purchase. I wasn't looking for wisdom. I was looking for permission, and found it in Dee's example. Jesus is in the transformation business. The lesson I learned from her story is that he often allows us to walk out our days as forgiven people living with the consequences of our choices.

As we Boomers move into our retirement years (whatever that career downshifting phase may look like, as many of us will need to continue working long past age 65), questions of legacy can drastically reshape our decisions. I don't want to be a financial burden to either my children or our society while I am alive. Because of this, I can't say I'm focused on storing up a big bulk of cash my grandkids can use to buy their own minivans someday. In addition, fear resulting in the hoarding of resources in order to "guarantee" future comfort and security for myself and my family does not reflect God's character or his intentions for us.

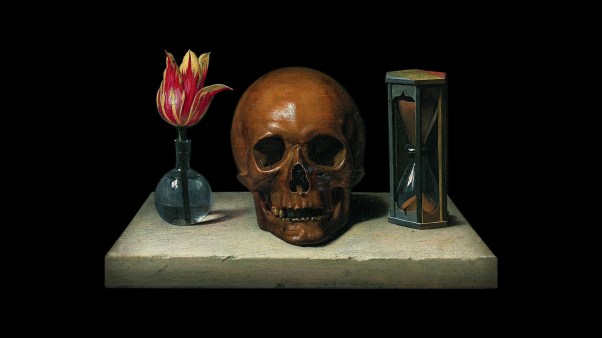

On the other hand, I am challenged by this verse in Proverbs: "A good person leaves an inheritance for their children's children, but a sinner's wealth is stored up for the righteous" (13:22). I love my family, and would take great joy in leaving them with enough to help them on their way, as well as giving to a couple organizations doing world-changing work. I long to be "a good person" in this regard. To that end, I can seek wise financial counsel for the resources I possess. But I cannot allow dollars and cents to define what my legacy will be. The numbers on a balance sheet may dip to zero via market forces, political upheaval, or health issues. Things don't last.

The minivan I purchased with my grandfather's money is long gone, but thankfully he left me more than a check. He gifted me with a keen interest in current events and a glimpse into the complex, sophisticated adult world that existed beyond my suburban backyard.

I pray my family and friends remember me after I'm gone as a person of great hope, deep faith, and abiding love. This legacy is the one I can choose to create each day, and costs me nothing. Nothing, that is, except the rest of my life.