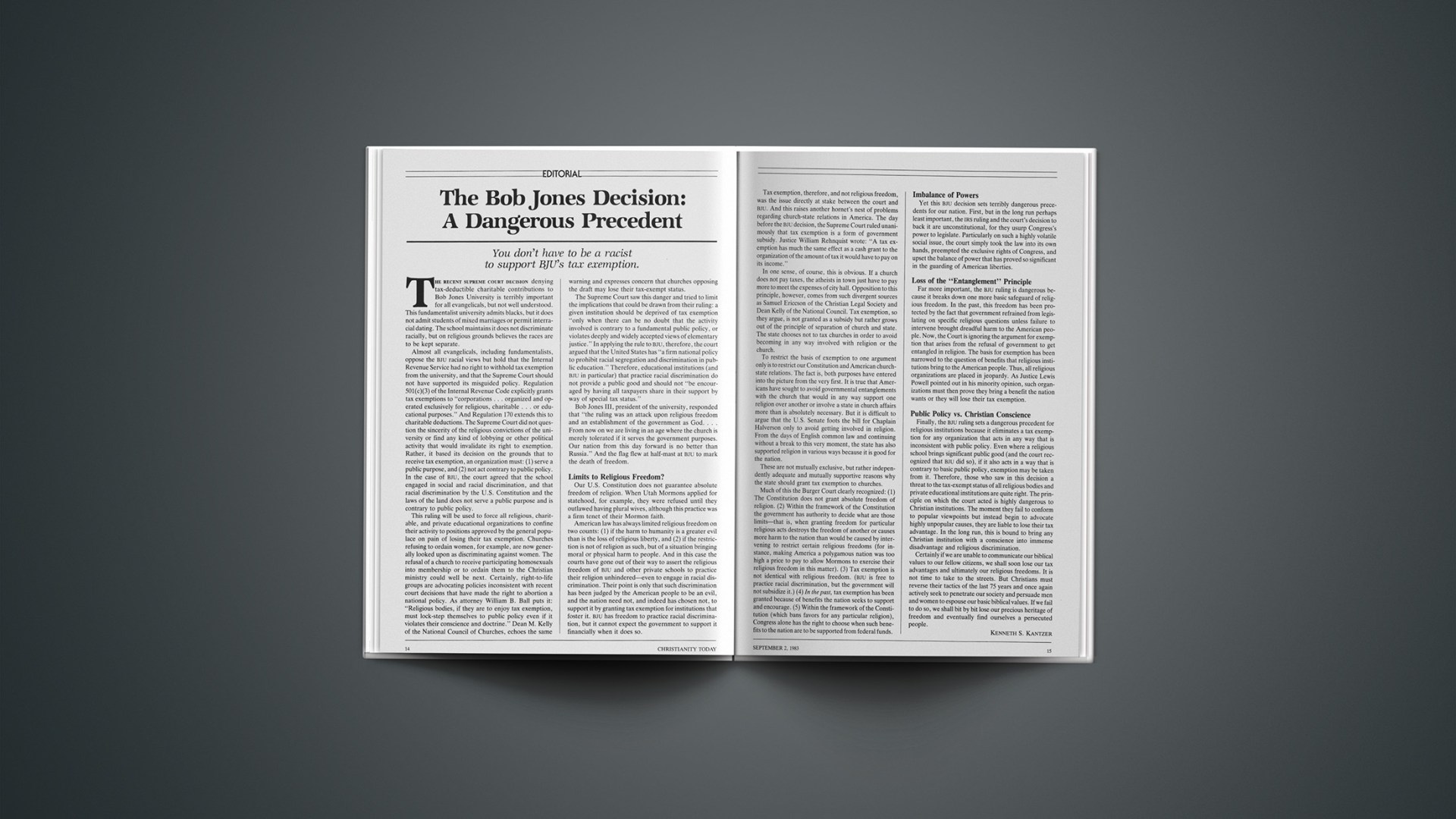

The recent Supreme Court decision denying tax-deductible charitable contributions to Bob Jones University is terribly important for all evangelicals, but not well understood. This fundamentalist university admits blacks, but it does not admit students of mixed marriages or permit interracial dating. The school maintains it does not discriminate racially, but on religious grounds believes the races are to be kept separate.

Almost all evangelicals, including fundamentalists, oppose the BJU racial views but hold that the Internal Revenue Service had no right to withhold tax exemption from the university, and that the Supreme Court should not have supported its misguided policy. Regulation 501(c)(3) of the Internal Revenue Code explicitly grants tax exemptions to “corporations … organized and operated exclusively for religious, charitable … or educational purposes.” And Regulation 170 extends this to charitable deductions. The Supreme Court did not question the sincerity of the religious convictions of the university or find any kind of lobbying or other political activity that would invalidate its right to exemption. Rather, it based its decision on the grounds that to receive tax exemption, an organization must: (1) serve a public purpose, and (2) not act contrary to public policy. In the case of BJU, the court agreed that the school engaged in social and racial discrimination, and that racial discrimination by the U.S. Constitution and the laws of the land does not serve a public purpose and is contrary to public policy.

This ruling will be used to force all religious, charitable, and private educational organizations to confine their activity to positions approved by the general populace on pain of losing their tax exemption. Churches refusing to ordain women, for example, are now generally looked upon as discriminating against women. The refusal of a church to receive participating homosexuals into membership or to ordain them to the Christian ministry could well be next. Certainly, right-to-life groups are advocating policies inconsistent with recent court decisions that have made the right to abortion a national policy. As attorney William B. Ball puts it: “Religious bodies, if they are to enjoy tax exemption, must lock-step themselves to public policy even if it violates their conscience and doctrine.” Dean M. Kelly of the National Council of Churches, echoes the same warning and expresses concern that churches opposing the draft may lose their tax-exempt status.

The Supreme Court saw this danger and tried to limit the implications that could be drawn from their ruling: a given institution should be deprived of tax exemption “only when there can be no doubt that the activity involved is contrary to a fundamental public policy, or violates deeply and widely accepted views of elementary justice.” In applying the rule to BJU, therefore, the court argued that the United States has “a firm national policy to prohibit racial segregation and discrimination in public education.” Therefore, educational institutions (and BJU in particular) that practice racial discrimination do not provide a public good and should not “be encouraged by having all taxpayers share in their support by way of special tax status.”

Bob Jones III, president of the university, responded that “the ruling was an attack upon religious freedom and an establishment of the government as God.… From now on we are living in an age where the church is merely tolerated if it serves the government purposes. Our nation from this day forward is no better than Russia.” And the flag flew at half-mast at BJU to mark the death of freedom.

Limits To Religious Freedom?

Our U.S. Constitution does not guarantee absolute freedom of religion. When Utah Mormons applied for statehood, for example, they were refused until they outlawed having plural wives, although this practice was a firm tenet of their Mormon faith.

American law has always limited religious freedom on two counts: (1) if the harm to humanity is a greater evil than is the loss of religious liberty, and (2) if the restriction is not of religion as such, but of a situation bringing moral or physical harm to people. And in this case the courts have gone out of their way to assert the religious freedom of BJU and other private schools to practice their religion unhindered—even to engage in racial discrimination. Their point is only that such discrimination has been judged by the American people to be an evil, and the nation need not, and indeed has chosen not, to support it by granting tax exemption for institutions that foster it. BJU has freedom to practice racial discrimination, but it cannot expect the government to support it financially when it does so.

Tax exemption, therefore, and not religious freedom, was the issue directly at stake between the court and BJU. And this raises another hornet’s nest of problems regarding church-state relations in America. The day before the BJU decision, the Supreme Court ruled unanimously that tax exemption is a form of government subsidy. Justice William Rehnquist wrote: “A tax exemption has much the same effect as a cash grant to the organization of the amount of tax it would have to pay on its income.”

In one sense, of course, this is obvious. If a church does not pay taxes, the atheists in town just have to pay more to meet the expenses of city hall. Opposition to this principle, however, comes from such divergent sources as Samuel Ericcson of the Christian Legal Society and Dean Kelly of the National Council. Tax exemption, so they argue, is not granted as a subsidy but rather grows out of the principle of separation of church and state. The state chooses not to tax churches in order to avoid becoming in any way involved with religion or the church.

To restrict the basis of exemption to one argument only is to restrict our Constitution and American church-state relations. The fact is, both purposes have entered into the picture from the very first. It is true that Americans have sought to avoid governmental entanglements with the church that would in any way support one religion over another or involve a state in church affairs more than is absolutely necessary. But it is difficult to argue that the U.S. Senate foots the bill for Chaplain Halverson only to avoid getting involved in religion. From the days of English common law and continuing without a break to this very moment, the state has also supported religion in various ways because it is good for the nation.

These are not mutually exclusive, but rather independently adequate and mutually supportive reasons why the state should grant tax exemption to churches.

Much of this the Burger Court clearly recognized: (1) The Constitution does not grant absolute freedom of religion. (2) Within the framework of the Constitution the government has authority to decide what are those limits—that is, when granting freedom for particular religious acts destroys the freedom of another or causes more harm to the nation than would be caused by intervening to restrict certain religious freedoms (for instance, making America a polygamous nation was too high a price to pay to allow Mormons to exercise their religious freedom in this matter). (3) Tax exemption is not identical with religious freedom. (BJU is free to practice racial discrimination, but the government will not subsidize it.) (4) In the past, tax exemption has been granted because of benefits the nation seeks to support and encourage. (5) Within the framework of the Constitution (which bans favors for any particular religion), Congress alone has the right to choose when such benefits to the nation are to be supported from federal funds.

Imbalance Of Powers

Yet this BJU decision sets terribly dangerous precedents for our nation. First, but in the long run perhaps least important, the IRS ruling and the court’s decision to back it are unconstitutional, for they usurp Congress’s power to legislate. Particularly on such a highly volatile social issue, the court simply took the law into its own hands, preempted the exclusive rights of Congress, and upset the balance of power that has proved so significant in the guarding of American liberties.

Loss Of The “Entanglement” Principle

Far more important, the BJU ruling is dangerous because it breaks down one more basic safeguard of religious freedom. In the past, this freedom has been protected by the fact that government refrained from legislating on specific religious questions unless failure to intervene brought dreadful harm to the American people. Now, the Court is ignoring the argument for exemption that arises from the refusal of government to get entangled in religion. The basis for exemption has been narrowed to the question of benefits that religious institutions bring to the American people. Thus, all religious organizations are placed in jeopardy. As Justice Lewis Powell pointed out in his minority opinion, such organizations must then prove they bring a benefit the nation wants or they will lose their tax exemption.

Public Policy Vs. Christian Conscience

Finally, the BJU ruling sets a dangerous precedent for religious institutions because it eliminates a tax exemption for any organization that acts in any way that is inconsistent with public policy. Even where a religious school brings significant public good (and the court recognized that BJU did so), if it also acts in a way that is contrary to basic public policy, exemption may be taken from it. Therefore, those who saw in this decision a threat to the tax-exempt status of all religious bodies and private educational institutions are quite right. The principle on which the court acted is highly dangerous to Christian institutions. The moment they fail to conform to popular viewpoints but instead begin to advocate highly unpopular causes, they are liable to lose their tax advantage. In the long run, this is bound to bring any Christian institution with a conscience into immense disadvantage and religious discrimination.

Certainly if we are unable to communicate our biblical values to our fellow citizens, we shall soon lose our tax advantages and ultimately our religious freedoms. It is not time to take to the streets. But Christians must reverse their tactics of the last 75 years and once again actively seek to penetrate our society and persuade men and women to espouse our basic biblical values. If we fail to do so, we shall bit by bit lose our precious heritage of freedom and eventually find ourselves a persecuted people.